Jane Doe #1 v. Mukwonago Area School District

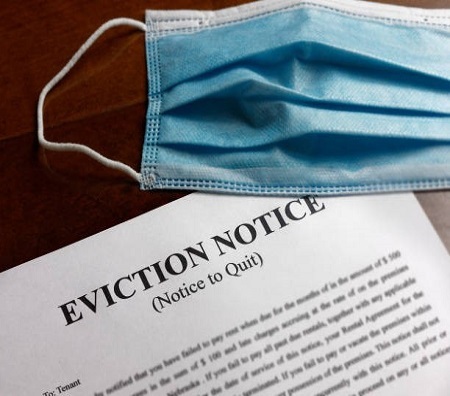

Jane Doe #1 v. Mukwonago Area School DistrictOn June 30, 2023, Relman Colfax filed this gender discrimination lawsuit against the Mukwonago Area School District (MASD) and its superintendent, Joe Koch, for denying Jane Doe #1, an eleven-year-old transgender girl, access to girls’ restrooms at school. (The girl’s name is being withheld to protect her privacy.) The complaint raises claims under Title IX of the Education Amendments of 1972 and the Equal Protection Clause.

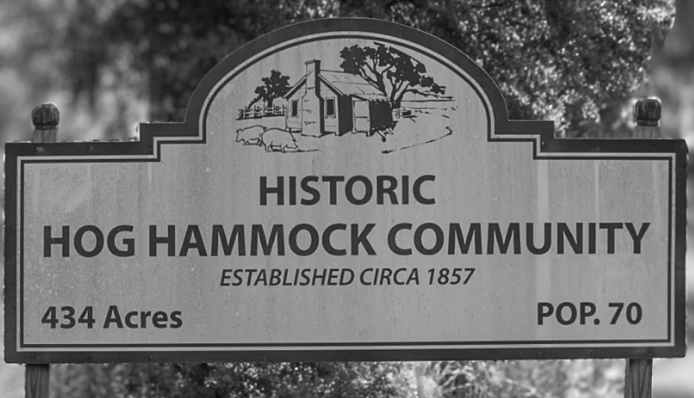

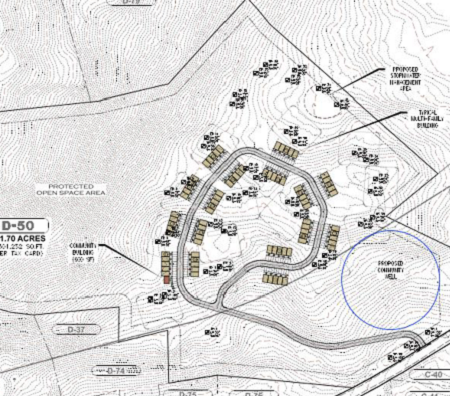

In August 2022, Relman Colfax settled an historic case challenging the failure of McIntosh County and the State of Georgia to provide equal services to the largest intact Gullah Geechee community in Georgia. Plaintiffs had alleged that Defendants failed to provide adequate water, emergency medical, fire, road maintenance, trash, and accessible ferry services to members of the community.

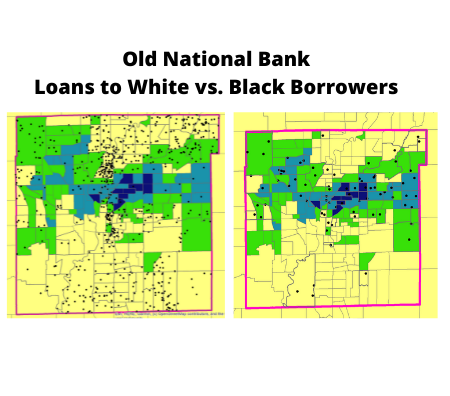

On January 7, 2022, Relman Colfax and co-counsel filed a class action lawsuit in federal court against Walden University, a for-profit university that offers online degree programs. This lawsuit alleges that Walden engaged in “reverse redlining” by intentionally targeting Black and female students in an expensive predatory scheme.

In February 2022, Relman Colfax settled one of the largest fair housing cases in the nation’s history, securing a significant victory for communities of color that were hit hard by the foreclosure crisis. As a result of the $53 million settlement, tens of millions of dollars will be invested in homeownership promotion, neighborhood stabilization, access to credit, property rehabilitation, and residential development.

Relman Colfax remembers our colleague and friend, Travis Beck, who passed away on October 10, 2022.

News & Updates

Relman Colfax Celebrates National Arab American Heritage Month

Relman Colfax Celebrates National Arab American Heritage Month Relman Colfax Celebrates Black History Month

Relman Colfax Celebrates Black History Month